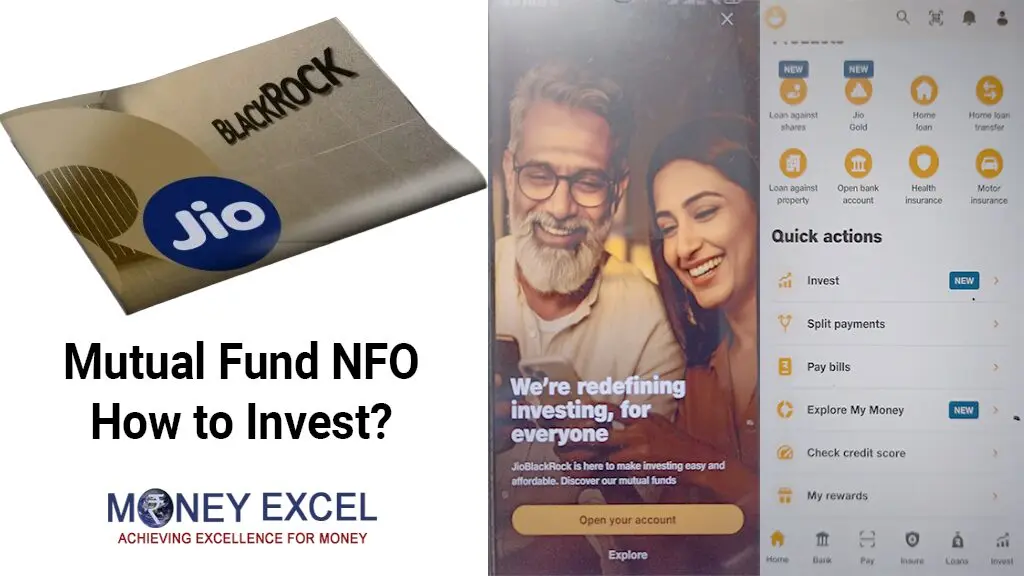

Jio BlackRock Mutual Fund: Complete Guide to Apply, Invest & Withdraw (2025)

What is Jio BlackRock Mutual Fund?

Jio BlackRock Mutual Fund is a new digital investment platform by Jio Financial Services and BlackRock, offering low-cost, secure, and easy mutual fund investment options in India.

How to Apply for Jio BlackRock Mutual Fund

- Download the Jio BlackRock app or visit the official website

- Complete KYC using Aadhaar and PAN

- Select your preferred mutual fund

- Choose SIP or Lump Sum and make payment

How to Withdraw Money from Jio BlackRock

Login to your Jio BlackRock account, go to your investments, select the mutual fund and choose Withdraw or Redeem. Money is credited in 1–3 working days.

Jio BlackRock Withdraw Process

Read More About Teen Patti Master App , Visit this website.

Frequently Asked Questions – Jio BlackRock Mutual Fund

- What is Jio BlackRock Mutual Fund? – It is a joint venture between Jio Financial Services and BlackRock, offering digitally accessible mutual funds for Indian investors.

- How can I invest in Jio BlackRock Mutual Fund? – Through their official app or website after completing your e-KYC using PAN and Aadhaar.

- Is Jio BlackRock Mutual Fund safe? – Yes, it’s regulated by SEBI and backed by Jio and BlackRock.

- What is the minimum investment amount? – You can start with as low as ₹100.

- How can I withdraw my investment? – Select your fund in the app and redeem. Funds reach your bank in 1–3 working days.

- Are there any lock-in periods? – Only ELSS funds have a 3-year lock-in. Others can be withdrawn anytime.

- Can I start an SIP? – Yes, SIPs are available with monthly auto-debit options.

- What documents are required for KYC? – PAN card, Aadhaar, bank details, and a selfie.

- Can I cancel my SIP anytime? – Yes, you can modify or stop your SIP in the app.

- How do I track my fund performance? – Use the dashboard in the app for real-time tracking and NAV updates.

- Is there a mobile app available? – Yes, it’s available on Play Store and App Store.

- What are the fees or charges? – No account fee. Direct plans are low-cost with small expense ratios.

- What if my SIP payment fails? – No penalty. It skips that cycle and continues next month.

- Can I invest in tax-saving funds? – Yes, ELSS funds allow deductions under Section 80C up to ₹1.5 lakh.

- How long does redemption take? – Typically 1–3 working days.

- Is Aadhaar mandatory? – Yes, it’s required for digital KYC.

- Can NRIs invest? – NRI onboarding may come later; currently for resident Indians.

- How is performance measured? – Managed by professionals from BlackRock; fund performance varies by market.

- How do I contact support? – Via in-app chat, email, or phone from the official site.

- Can I transfer existing funds? – You may transfer supported funds via CAS. Contact support for help.

Post Comment